Menu

BSP Continues Push for Digitalization of Microfinance Sector

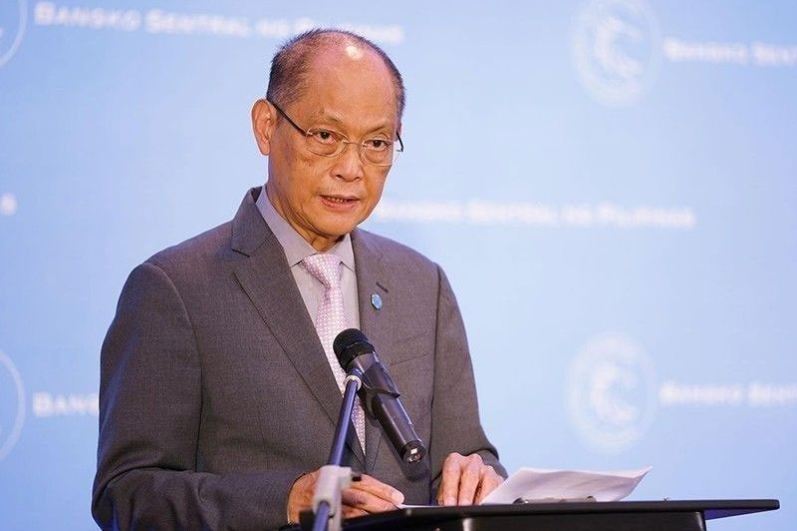

Microfinance institutions (MFIs) play a significant role in allowing micro and small enterprises, especially those in rural areas, to access financial products and services. With this, the Bangko Sentral ng Pilipinas (BSP) maintains its commitment to support the microfinance sector. “Through the NSFI [National Strategy for Financial Inclusion] 2022-2028, the BSP remains steadfast in promoting a whole-of-nation undertaking that will enable microfinance to thrive and remain vibrant in the post-Covid-19 economy,” explained BSP Governor Benjamin Diokno on Thursday.

Diokno noted that MFIs will be able to expand their reach as they embrace digital transformation, particularly if they utilize digital loan disbursement and collection, online payment gateways, and mobile apps. “Case-in-point, a rural bank in Albay developed a mobile app that can be accessed using free data for subscribers of its partner telco company. Similarly, a thrift bank launched a mobile app to enable its microfinance clients to check their payment schedule and settle their loan obligations remotely,” he elaborated.

Around 84% of local government units have access to MFIs, making these institutions strategic partners in forwarding the government’s plans of achieving financial inclusion. Additionally, 57% of unbanked LGUs also have MFI presence. “Today, 144 banks are engaged in microfinance. They provide safe and affordable financial services to around 2 million borrowers with (a) total microfinance loan portfolio of ₱26 billion,” Diokno added.

It has also been found that non-bank MFIs have been able to assist 8.8 million members providing ₱288 billion worth of outstanding loans. Meanwhile, microfinance non-governmental organizations have served 6.2 million clients with a total loan of ₱50 billion. “With that, the BSP recognizes the potential of technology as a game-changer for microfinance.”

MFIs have also been pursuing innovations in back-end operations — such as credit scoring and decision models, and automated financial management systems — through subscriptions to software-as-a-service (SaaS) and web portals. “One of the pioneering banks relying on cloud-based SaaS for core banking is a rural bank in Mindanao. This cloud-based system has enabled the bank to manage its day-to-day operations more effectively and serve its clients more efficiently,” Diokno indicated.

The digital transformation of MFIs will help microfinance clients transition from cash to digital transactions, pushing the BSP’s Digital Payments Transformation Roadmap aimed at the digital conversion of 50% of retail payments and the onboarding of 70% of Filipino adults to own a transaction account by 2023.

“In line with this, we are encouraging development partners and experts to continue extending technical assistance that will build the capacities and provide opportunities for MFIs to adopt digital innovations,” said Diokno. “Collaboration is instrumental in the establishment of shared digital platforms or facilities among MFIs to create a multiplier effect on the microfinance sector.”

Sources: Manila Times, Philippine News Agency

#Top Tags COVID Covid-19 Technology Finance Investing Sustainability Economy

Subscribe to Our Newsletter and get a free pdf:

Comments are closed for this article!