Menu

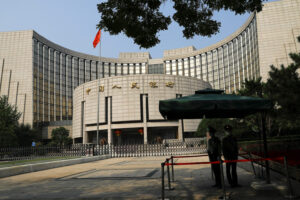

China’s Central Bank Holds Steady Amid Global Economic Flux

- Junnel G

- March 14, 2024

- 6:00 pm

In an anticipated move reflecting China’s cautious approach to monetary policy amidst global economic uncertainties, the People’s Bank of China (PBOC) is poised to keep a key policy rate steady. This decision comes as the bank prepares for the rollover of maturing medium-term loans this Friday, signaling a prioritization of currency stability over aggressive stimulus measures.

The decision to maintain the one-year medium-term lending facility (MLF) loans interest rate at 2.50% aligns with the broader sentiment among market observers. In a recent Reuters survey involving 36 participants, a significant majority (89%) anticipated this outcome, underscoring a consensus that any premature rate cuts could risk further pressure on the yuan. This stance is particularly relevant in light of the yuan’s 1.3% depreciation against the dollar this year, despite ongoing efforts by the central bank to bolster the currency.

China’s monetary policy strategy appears to be in a holding pattern, awaiting cues from the Federal Reserve’s potential interest rate cuts expected later in the year. Market predictions currently favor a 65% likelihood of a Fed rate reduction by June, with expectations adjusting dynamically in response to global economic indicators and inflation trends. This international monetary landscape complicates the PBOC’s calculus, as any unilateral action could exacerbate capital outflows or destabilize the exchange rate.

Analysts and traders are eyeing the Fed’s moves closely, suggesting that any easing of policy stateside could provide the PBOC with the leeway needed to adjust borrowing costs in support of domestic economic growth. Despite these pressures, recent statements from PBOC Governor Pan Gongsheng indicate a commitment to maintaining the yuan’s stability, coupled with a hint at possible future monetary easing through both rate cuts and adjustments to banks’ reserve requirement ratios (RRR).

As the global economy navigates a complex interplay of inflationary pressures, currency fluctuations, and geopolitical tensions, China’s central banking strategy represents a cautious balancing act. The PBOC’s immediate focus on stabilizing the yuan while keeping a close watch on international monetary policy shifts underscores the intricate challenges facing global financial systems today.

#Top Tags COVID Covid-19 Technology Finance Investing Sustainability Economy

Subscribe to Our Newsletter and get a free pdf:

Comments are closed for this article!